Things looked bleak in early 2025. The Israel-Gaza war was escalating with failed ceasefire attempts. Wildfires raged in California. The “Mag 7” had contributed more than half of the 2024 stock market return, and as stock prices dropped in the first few months of 2025, some people feared that an AI bubble was beginning to pop.

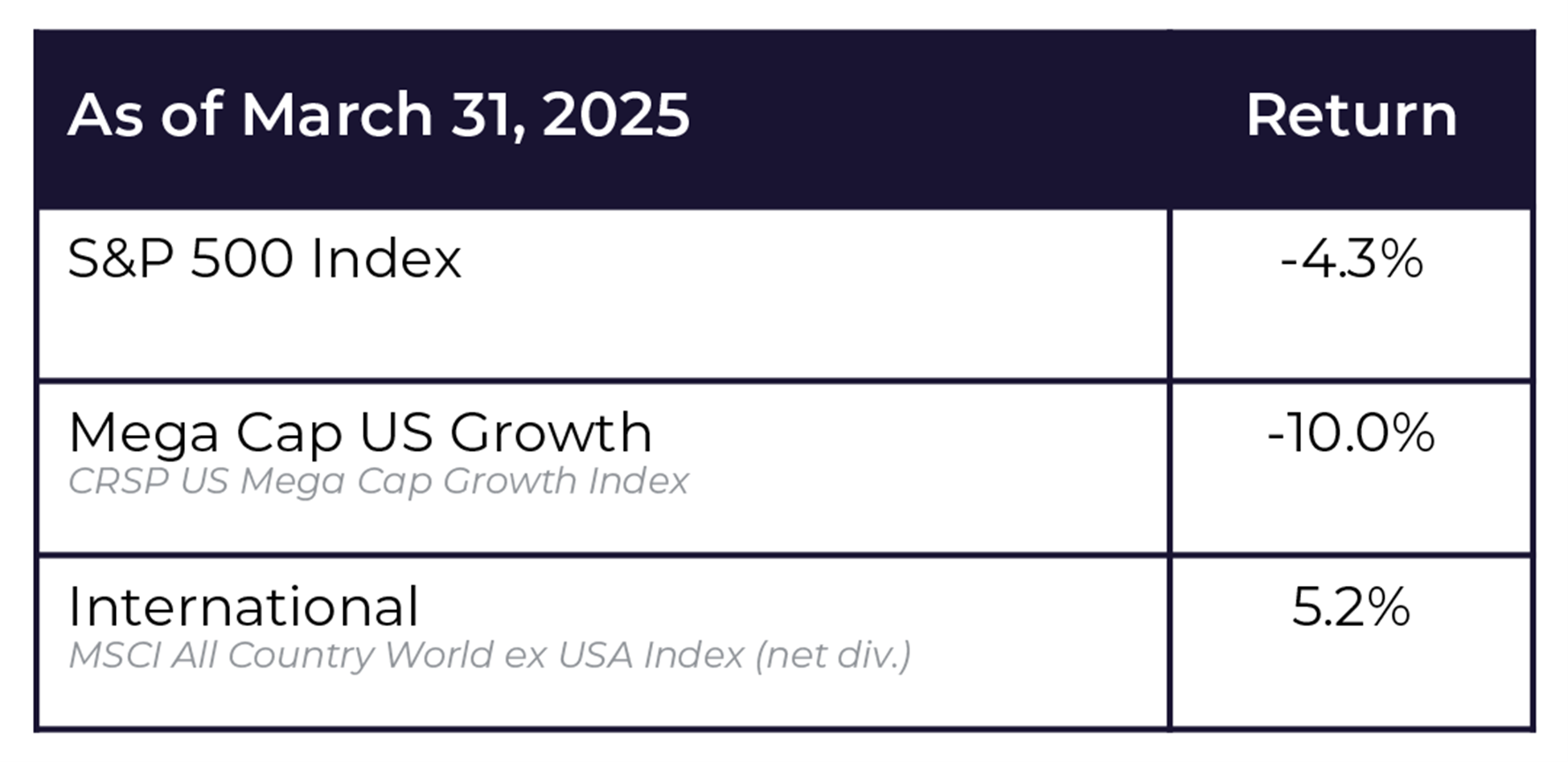

The outlook didn’t look good, and stock markets reflected that:

And this was before the sharp drop in the first week of April after the “Liberation Day” tariff announcements.

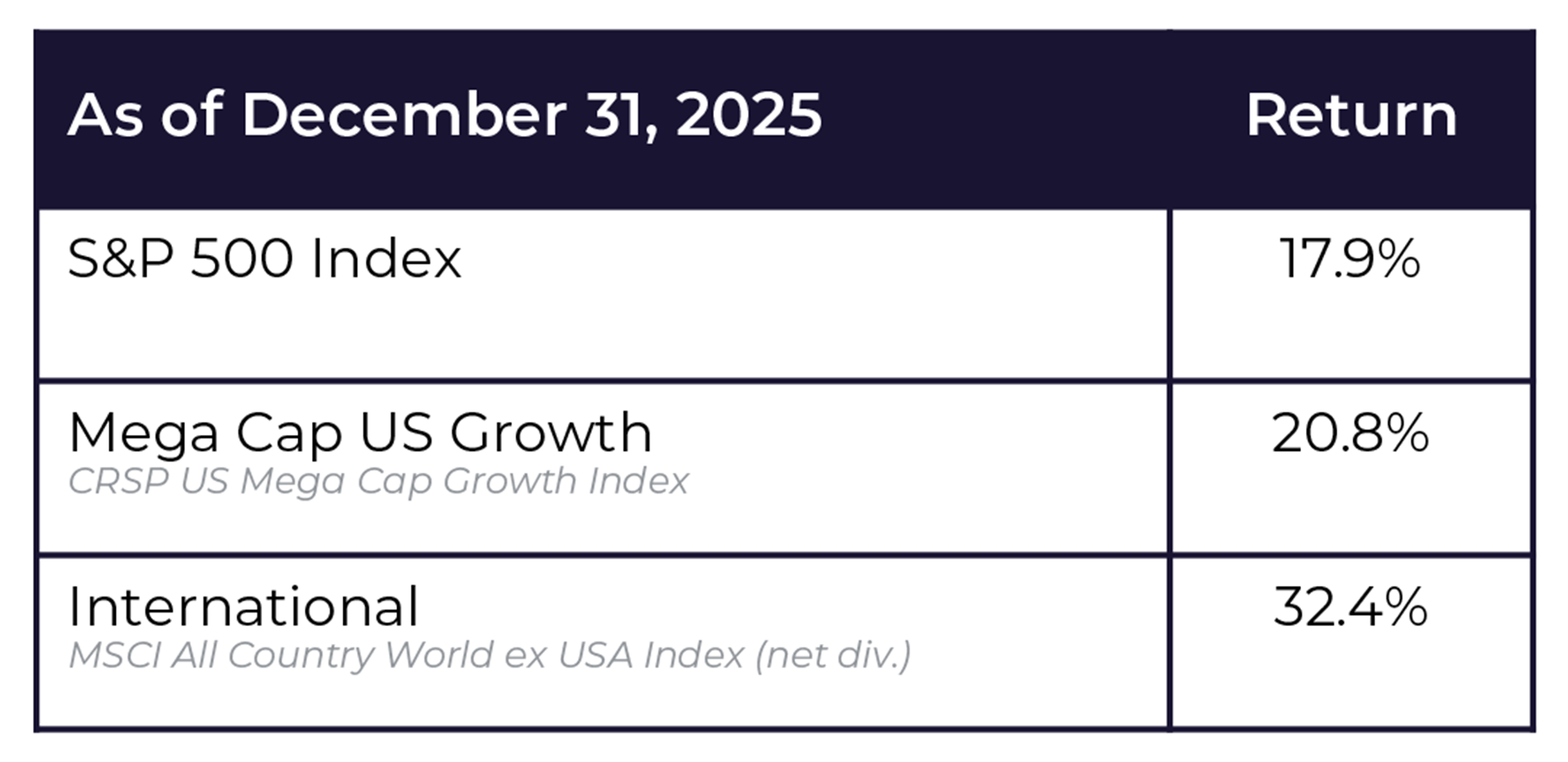

Let’s skip ahead to the spoiler. By the end of the year, stock markets were up globally:

I heard someone say, “If you sell in the gloom, you might miss the bloom”.

What does that mean exactly? When most of the current news is negative, that bad news is already baked into current stock prices. Bad news does not project, nor predict, future market lows. By the time things start looking sunny again, most of the recovery likely already happened, and investors trying to time the bottom will have missed out on most of the upswing.

This simple but elusive idea is why market timing is nearly impossible in practice. At the bottom, things will look like they’re going to get even worse. We believe the best strategy is not to avoid further losses, but to rebalance back into stocks and maintain a disciplined portfolio approach.

Set a long-term portfolio allocation before the downturn happens. The stock percentage should only be set as high as your risk tolerance (the combination of your ability to take risk and your willingness to take that risk) will allow.

In 2025, we re-learned the importance of that simple framework. Staying the course worked yet again, and those who followed a disciplined rebalancing process benefited. Patience Rewarded.

The gloom will happen again. If there’s anything in markets that is a sure thing, it is that things do not go up in a straight line. Markets, like life, are messy, and there are ups and downs along the way. As investors, we are compensated in the long term for taking that risk. Without risk, there would be no return. There will be downturns in the future, and we need to be ready for them, positioned in a way that we can stay in our seats for the duration of the roller coaster ride.

Will you be able to stick with your portfolio through the next drop and recovery? If you don’t think so, it’s imperative we have a conversation and revisit the framework of your portfolio. Ensuring your portfolio is aligned with your risk tolerance is much easier and better to do before the next storm rather than during it.

Sources:

• S&P 500 Index returns: S&P Dow Jones Indices.

• Mega Cap US Growth returns: CRSP US Mega Cap Growth Index, Center for Research in Security Prices (CRSP).

• International returns: MSCI All Country World ex USA Index (net dividends), MSCI Inc.

Data as of March 31, 2025 and December 31, 2025. Returns represent index performance and do not reflect any fees or expenses. Indices are unmanaged and cannot be invested in directly.